September 3, 2025

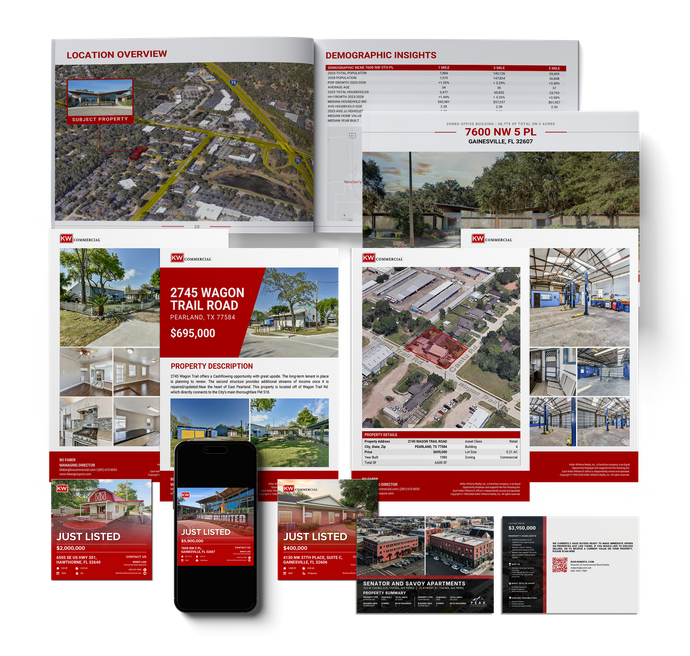

Navigating the commercial real estate (CRE) market often feels like trying to crack a complicated code. Prices swing in one sector, stagnate in another, and global capital flows can transform the playing field in a matter of months. With so many moving parts, it’s easy to feel like the landscape is too complex to master. But what if you had a playbook that simplified these dynamics into clear, actionable strategies you could use with your clients? That’s the value of Alicia Shepherd and the Launch Commercial Real Estate Network . Launch has built a reputation for taking global trends and capital movements and translating them into scripts, strategies, and negotiation leverage that brokers and investors can use immediately. In this post, we’re unpacking highlights from Launch’s most recent State of the Market Call , covering macroeconomic trends, sector-specific insights, and tactical plays to help you not just keep up, but get ahead. I. Macro and Capital Market Overview Capitalizing on Capital Flows: Understanding the Economic Landscape The second quarter of 2025 paints a picture of a market that is not collapsing but reorganizing itself. Transaction volume reached $115 billion , which represents a 3.8% increase compared to the previous quarter but a 7.4% drop compared to last year. At the same time, the median price per square foot climbed nearly 14% year-over-year , showing that while fewer deals are getting done, the ones that do close are larger and command higher premiums. In other words, investors are concentrating their capital in fewer, safer bets. The message for clients is clear: capital is still flowing, but much more selectively. Investors should not expect a flood of indiscriminate deals. Instead, they should focus their attention on high-quality opportunities that align with the cautious preferences of today’s capital markets. One of the most telling signals comes from the Carlisle Group , which raised a $9 billion fund targeting resilient asset classes such as multifamily housing, logistics, industrial, and self-storage. These sectors are attracting capital because they are seen as durable through economic cycles. Notably absent from Carlisle’s strategy are office, hotels, and traditional retail—categories that continue to face structural challenges. This provides a useful client script: “Smart capital reveals future trends. Carlisle’s allocation shows us where confidence lies, and where caution dominates.” Having this framing ready for client conversations positions you as someone who isn’t just watching the market, but interpreting it. Of course, credibility requires balance. It’s just as important to prepare clients for the downside. Office, hotels, and outdated retail formats all carry risks, and investors should recognize that cracks will continue to emerge in these challenged categories. II. Sector Deep Dives Multifamily: A Rock in Commercial Real Estate The multifamily sector continues to act as a cornerstone of the CRE landscape. Absorption is up 20% year-over-year , new completions are down 9% , and vacancy sits at 8.1% . Rent growth has stabilized, albeit modestly, reflecting a return to investment fundamentals. Multifamily’s performance highlights its role as a hedge against inflation and volatility . Well-located Class A properties remain strong performers, while workforce housing provides stability in a sector where demand is tied to basic necessity. For investors, multifamily resembles a blue-chip stock —steady, resilient, and essential. Office: Prime vs. Obsolete The office sector continues to be the most polarizing story in CRE. Overall vacancy stands at 14.1% , but that number hides an important divide. Class A assets are showing positive absorption , while Class B and C buildings are experiencing negative absorption . The difference is stark: trophy towers are thriving, while obsolete buildings struggle to find tenants . JP Morgan’s $3 billion investment in a new Midtown headquarters is a prime example. Far from abandoning office, they are betting on the future of modern workspaces with top-tier amenities and sustainability at the core. This makes for an easy client takeaway: “ It’s not office versus no office—it’s prime versus obsolete.” Meanwhile, adaptive reuse is opening up new opportunities. In Houston, a 27-story office tower is being converted into apartments and corporate suites. Projects like this address both housing shortages and the problem of office oversupply. They also remind us that not every underperforming building is destined to remain obsolete—many can be reborn if feasibility, zoning, and code requirements align. Industrial: A Tale of Two Markets Industrial has long been a darling of investors, but the sector is now showing a split personality. Vacancy has climbed to 7.4% , and rent growth has slowed to 1.7% . Much of this softness comes from oversupply in large logistics facilities. At the same time, small bay and last mile properties remain in extremely high demand . These facilities are critical for e-commerce and local distribution, and tenants are still willing to pay a premium for them. The strategy here is straightforward: pivot portfolios toward small bay and last mile assets while getting creative with oversupplied big box facilities. Consider alternative uses such as cold storage, indoor sports venues, or even film production hubs. To think outside the box, lean on AI brainstorming tools like ChatGPT or Gemini , which can generate unconventional ideas for repositioning properties that might otherwise sit idle. Retail: Resilient and Resetting Retail is quietly making a comeback. Vacancies remain low, investment is increasing, and new store openings are outpacing closures. The winners are clear: grocery-anchored shopping centers and experiential retail hubs are thriving, particularly in open-air formats that attract consistent foot traffic. For investors, retail is no longer the risk story it was painted to be a few years ago. Instead, it is proving resilient by focusing on necessity-based and lifestyle-driven demand . This trend creates opportunities for brokers and developers to be proactive. For example, you could host a panel discussion with local business owners about the “retail reset” and use that conversation to highlight the evolution of shopping centers. Not only does this build community credibility, it also positions you as a thought leader in a sector that many people have prematurely written off. III. Capital Strategy and Alternative Plays Capitalizing on Opportunities: Equity, Refinance, and Leasing Behind the sector-specific headlines, there is a broader financial story: nearly $3 trillion in capital is being reassessed as investors rethink their allocations. That capital is not disappearing—it is waiting for clarity. For brokers and investors, the move is to help clients stabilize assets now. Whether through targeted leasing strategies, refinancing, or operational improvements, the goal is to position properties for best-in-market pricing when the next wave of capital re-engages. Data Centers: The AI-Driven Real Estate Frontier Perhaps the most exciting frontier is the rise of data centers. With artificial intelligence fueling explosive growth in digital infrastructure, demand for data storage and processing capacity is skyrocketing. JP Morgan and MUFG recently financed a $22 billion data campus , underscoring the scale of opportunity. Investors interested in this sector should pay attention to two things: power and location. Data centers require immense electrical load capacity, so not every building is a candidate. Tools like Landgate can help assess a property’s suitability. On the brokerage side, AI can be leveraged to build custom GPTs that automatically answer client questions about data centers or surface timely articles, keeping both agents and clients ahead of the curve. Conclusion The story of CRE in 2025 is not one of collapse, but of sorting and specialization. Multifamily and retail remain resilient. Trophy towers thrive while obsolete office stock falls behind. Industrial is bifurcating between oversupply and scarcity. And data centers are quickly becoming the next frontier, driven by the rise of artificial intelligence. The challenge for you is simple: take one statistic, one property type, and one client conversation from this blog, and put it into action this week. Prove that you’re not just following the market—you’re leading it. Stay sharp. Stay bold. And let’s launch forward. Additional Tips for Agents and Investors Use visuals. Data by itself can overwhelm, but charts and graphs make the story clear. A simple side-by-side of Class A vs. Class B office absorption communicates the “prime vs. obsolete” theme instantly. When clients can see the data, they’re more likely to trust your analysis. Leverage quotes. A powerful line from Alicia Shepherd—such as “Smart capital reveals future trends” —does more than provide context. It anchors your narrative in authority and gives clients something memorable to hold onto. When repurposed for LinkedIn or Instagram, these quotes also double as shareable graphics. Keep it scannable. Time is scarce for investors. Use clear headings, subheadings, and short paragraphs so readers can extract value even if they skim. A client might only read enough to remember that multifamily absorption is up 20%, but that’s enough to spark a conversation. Think SEO. Search engines are how many prospects will find you. By weaving in relevant phrases like “multifamily investment strategy” or “office-to-residential conversion” , your blog can surface when decision-makers are actively researching those topics. A well-optimized article isn’t just content—it’s a lead magnet. Promote broadly. Publishing is just step one. Share your insights across LinkedIn, Twitter/X, Instagram, and your email newsletter. Adapt the content to fit the platform—quotes for social, charts for LinkedIn, and a “stat of the week” for email. Each share amplifies your reach and reinforces your positioning as a thought leader.